Are you gambling with your retirement based on outdated math from the 1990s? The famous 4% rule once promised a worry-free retirement, but it’s silently destroying nest eggs across America.

Your financial advisor might still preach this “proven” strategy, yet they’re not telling you about the devastating flaws that could leave you broke in your golden years.

From hidden tax traps to the harsh reality of today’s market conditions, this retirement rule is crumbling faster than your 401(k) in a bear market. Before you stake your future on this dangerous myth, let’s uncover what the retirement industry doesn’t want you to know.

1. The “50/50 Portfolio” Myth

The traditional 4% rule’s assumption of a balanced 50/50 split between stocks and bonds has become increasingly problematic for modern retirees, particularly those with more conservative investment approaches.

When portfolios skew heavily toward risk-averse allocations, such as those containing only 20% stocks, the mathematical foundation of the 4% withdrawal rate begins to crumble.

The fundamental issue lies in the rate of principal depletion versus investment gains. premature portfolio failure.

Tips:

- Consider your risk tolerance carefully when determining portfolio allocation

- Evaluate whether a more balanced approach might better serve long-term needs

- Regular portfolio rebalancing is crucial to maintain desired risk levels

- Work with a financial advisor to determine the optimal stock/bond ratio for your situation

2. Hidden Tax Drain

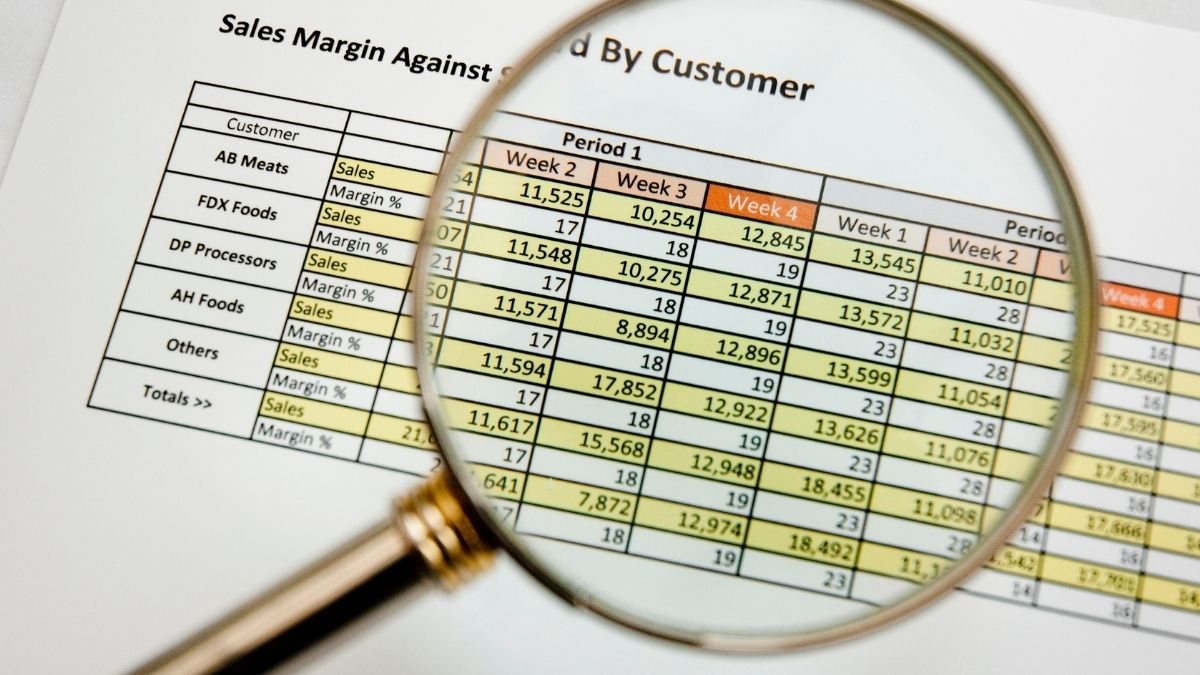

The impact of taxation on retirement withdrawals represents a significant oversight in the traditional 4% rule calculations. Using a million-dollar portfolio as an example, the seemingly straightforward withdrawal of $40,000 annually becomes considerably less when tax implications are considered.

After accounting for federal, state, and sometimes local taxes, many retirees find their actual spendable income reduced to approximately $30,000-$32,000.

This 0.5% reduction in effective withdrawal rate due to taxes can significantly impact lifestyle expectations and long-term financial planning. The tax burden effectively transforms the 4% rule into a 3.5% reality for many retirees.

Tips:

- Consider tax-efficient withdrawal strategies across different account types

- Explore Roth conversion opportunities before retirement

- Understand your tax bracket and how it affects withdrawal planning

- Consult with a tax professional to optimize retirement account distributions

3. Fees: The Silent Killer

The often-overlooked impact of investment and advisory fees can dramatically erode retirement savings over time. A seemingly modest 1% annual advisor fee effectively reduces the first-year spendable income by a quarter, while additional fund management fees and administrative costs can push the total fee burden even higher.

When these fees are combined with the standard 4% withdrawal rate, retirees must effectively withdraw 5-6% of their portfolio annually to achieve their desired 4% net income.

This accelerated withdrawal rate significantly increases the risk of portfolio depletion and can undermine even the most carefully planned retirement strategies.

Tips:

- Regularly review and compare investment fees across different funds

- Consider low-cost index funds as alternatives to actively managed options

- Negotiate advisory fees when possible, especially for larger portfolios

- Calculate the total expense ratio of your investment strategy annually

4. Longevity Blind Spot

The traditional 4% rule was designed with a 30-year retirement horizon in mind, but this timeline becomes inadequate for individuals retiring early, particularly those leaving the workforce at 55 or younger.

For these early retirees, a retirement span of 40 years or more is increasingly common, making the standard withdrawal rate potentially dangerous.

Even reducing the withdrawal rate to 3.3% may not provide adequate protection against portfolio depletion over such extended periods. This longevity risk is particularly concerning as life expectancies continue to increase and more people opt for early retirement.

Tips:

- Factor in family health history when planning retirement length

- Consider multiple withdrawal rates for different retirement phases

- Build additional safety margins into early retirement planning

- Explore longevity insurance or annuities as backup protection

5. Inflation’s Double-Edged Sword

While the 4% rule accounts for general inflation through CPI-adjusted withdrawals, it fails to adequately address the disproportionate impact of healthcare inflation on retiree spending.

Healthcare costs consistently rise at 6-7% annually, significantly outpacing the general inflation rate. This disparity forces many retirees to reduce their discretionary spending to accommodate rising medical expenses.

The rule’s simplified approach to inflation adjustment doesn’t reflect the real-world spending patterns of retirees, where healthcare often becomes an increasingly larger portion of the budget over time.

Tips:

- Build a separate healthcare inflation factor into retirement planning

- Consider Health Savings Accounts (HSAs) for tax-advantaged medical savings

- Research Medicare supplement insurance options early

- Create a dedicated healthcare emergency fund

6. Sequence Risk Roulette

The impact of market timing and sequence of returns risk presents a significant challenge to the 4% rule’s effectiveness. When retirees encounter a severe market downturn early in retirement, such as the 2008 financial crisis, the combination of portfolio losses and continued withdrawals can create a permanent impairment to their retirement savings.

The rule’s rigid withdrawal structure doesn’t account for these market dynamics, potentially forcing retirees to sell assets at depressed prices to maintain their income level.

Unlike dynamic withdrawal strategies that adjust to market conditions, the fixed nature of the 4% rule can amplify losses during challenging market periods.

Tips:

- Build a cash buffer to avoid selling during market downturns

- Consider dynamic withdrawal strategies that adjust to market conditions

- Diversify across multiple asset classes to reduce market risk

- Maintain an emergency fund separate from retirement portfolio

7. Bond Yields: The Broken Backbone

The historical foundation of the 4% rule was built on bond yields averaging 7.6% during the period of William Bengen’s original research (1960s-90s).

Today’s significantly lower interest rate environment, with yields around 4%, fundamentally alters the mathematics behind the rule. This reduced yield environment means bonds provide less income and less potential for capital appreciation, making it harder for portfolios to sustain the traditional 4% withdrawal rate.

The dramatic shift in the fixed-income landscape challenges the very assumptions that made the rule viable in past decades.

Tips:

- Explore alternative fixed-income strategies beyond traditional bonds

- Consider dividend-paying stocks as a partial bond alternative

- Evaluate bonds of different durations and credit qualities

- Review bond allocation strategy regularly in light of yield changes

8. “Worst-Case” ≠ Your Case

The 4% rule’s focus on surviving the worst historical market scenarios, such as the 1929 Great Depression, creates an overly conservative approach that may unnecessarily restrict retirement spending for most retirees.

Research shows that 90% of retirees following this rule actually end up with more money than they started with, suggesting that many retirees could safely withdraw more.

This overcautious approach can lead to a reduced standard of living during retirement years when retirees could actually afford to spend more.

Tips:

- Consider personal circumstances rather than just historical worst cases

- Develop a more flexible withdrawal strategy based on market conditions

- Review and adjust withdrawal rates periodically based on portfolio performance

- Balance current lifestyle needs with legacy goals

9. One-Size-Fits-Nobody Spending

The 4% rule’s assumption of steady, inflation-adjusted spending throughout retirement contradicts actual retiree behavior patterns, particularly the well-documented “Retirement Spending Smile.”

Research shows that retirees naturally reduce their spending by 20-30% in their 80s, with expenses typically highest in the early retirement years and again in the later years due to medical costs.

By forcing inflation-adjusted increases regardless of actual spending needs, the rule can lead to excessive saving and unused funds. This rigid approach fails to account for the natural evolution of retirement spending patterns, potentially leaving retirees with significant unused assets while unnecessarily restricting their earlier retirement lifestyle.

Tips:

- Plan for varying spending levels across different retirement phases

- Create separate budgets for discretionary and essential expenses

- Review and adjust spending patterns based on lifestyle changes

- Consider higher withdrawal rates during active retirement years

10. Social Security Blind Spot

The 4% rule’s notable oversight of Social Security benefits, which typically provide 30-50% of average retiree income, represents a significant planning gap.

This guaranteed income stream could potentially allow for higher portfolio withdrawal rates, yet it’s rarely integrated into withdrawal strategy models.

The failure to consider Social Security’s inflation-adjusted, guaranteed income stream in retirement planning can lead to overly conservative withdrawal rates and suboptimal retirement income strategies.

Tips:

- Calculate Social Security’s impact on total retirement income needs

- Consider delayed Social Security claims to maximize benefits

- Integrate Social Security planning with portfolio withdrawal strategy

- Review annual Social Security statements for accurate benefit estimates

FINAL THOUGHTS AND COMPREHENSIVE TIPS:

The 4% rule, while providing a useful starting point for retirement planning, requires significant modification for modern retirees. Consider these overarching recommendations:

- Develop a flexible withdrawal strategy that adapts to changing market conditions and personal circumstances

- Regular review and adjustment of retirement plans is crucial for long-term success

- Consider working with financial professionals who understand these complexities

- Build multiple contingency plans into your retirement strategy

- Maintain an emergency fund separate from your retirement portfolio

- Stay informed about changes in tax laws, Social Security benefits, and healthcare costs

- Consider the role of guaranteed income sources in your retirement plan

- Focus on creating a sustainable, personalized withdrawal strategy rather than adhering strictly to the 4% rule

- Plan for different phases of retirement with varying spending needs

- Regularly reassess your risk tolerance and investment allocation