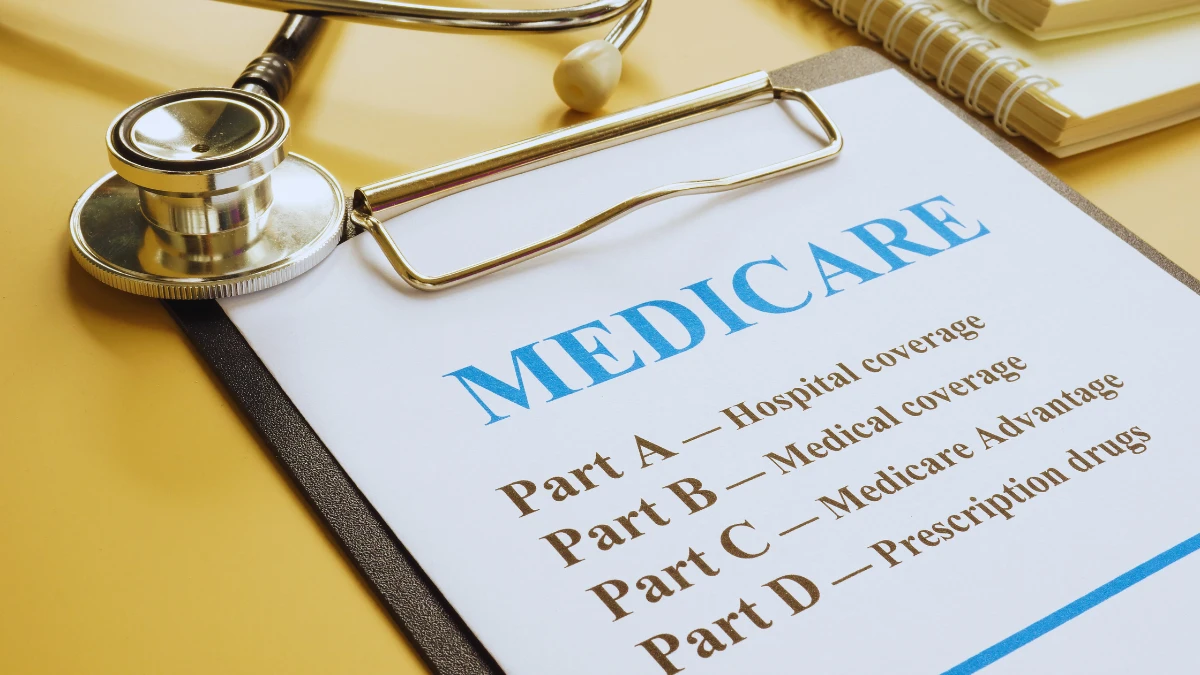

Note: While some sources claim 40% denial rates, current data shows Medicare denies 8.4% of traditional claims and 16-17% of Medicare Advantage claims, still affecting millions of seniors.

Your doctor says you need surgery. Medicare pre-approves it. Then the bill arrives.

DENIED.

You’re stuck with a $15,000 medical bill you can’t pay. Sound familiar?

You’re not alone. Medicare and Medicare Advantage plans deny millions of claims every year. Traditional Medicare denies 8.4% of claims, while Medicare Advantage denies 15.7% – that’s roughly one in six claims being rejected.

But here’s what makes you angry: More than half of these denials get overturned when challenged. That means Medicare knew the claims were valid but denied them anyway.

The cost? Healthcare providers spend $19.7 billion every year just fighting these denials. And guess who pays for that in the end? You do, through higher medical costs.

In this guide, you’ll learn the 9 sneaky tactics Medicare uses to deny your claims. More importantly, you’ll discover how to fight back and win.

The Real Numbers: How Many Claims Actually Get Denied

Let’s start with facts. A 2024 survey found that nearly 15% of all claims submitted to private payers for reimbursement were initially denied. For Medicare specifically:

- Traditional Medicare: 8.4% denial rate

- Medicare Advantage: 16-1%7 denial rate

- Some Medicare Advantage plans: Up to 22% denial rate

That might not sound like 40%. But when you factor in prior authorization denials, appeals, and repeated claim submissions, the real impact hits much harder.

Medicare Advantage plans denied 3.4 million prior authorization requests in 2022 alone. These aren’t even claims yet – they’re requests for permission to get care.

The financial damage is real. Hospitals spend an average of $47.77 fighting each Medicare Advantage denial. Multiply that across millions of claims, and you see why medical costs keep rising.

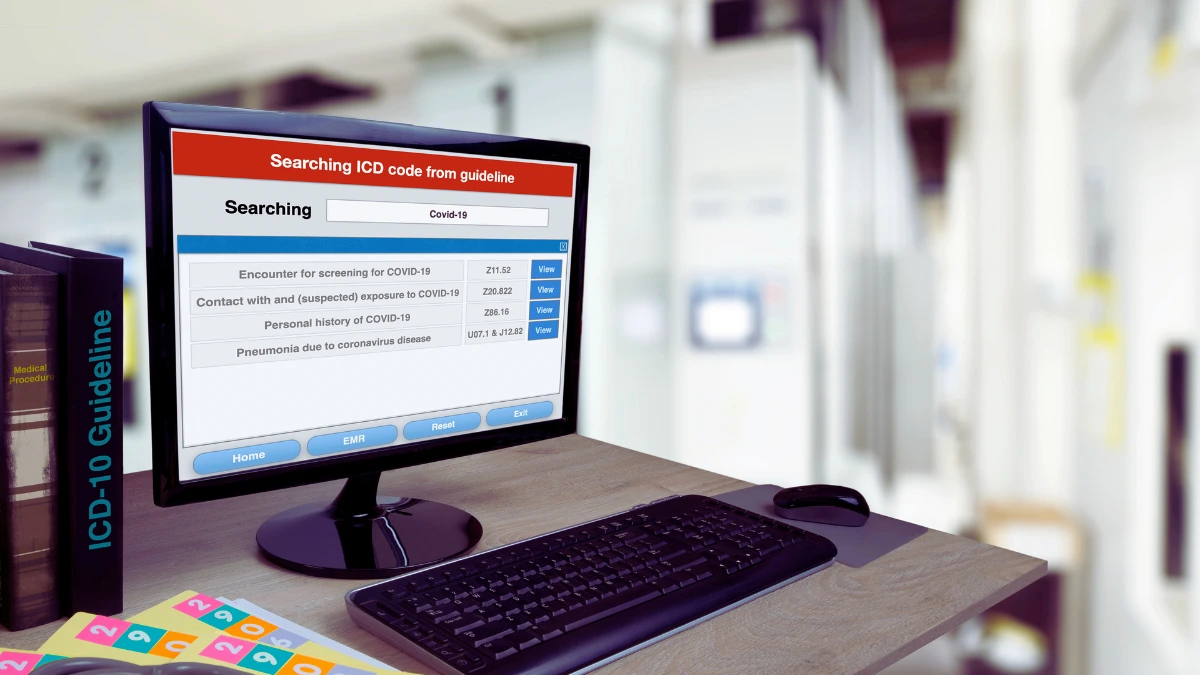

Tactic #1: The ICD-10 Coding Trap That Triggers Automatic Rejections

Here’s how this scam works: Medicare requires doctors to use specific codes for every diagnosis and treatment. These ICD-10 codes have over 70,000 options.

Get one digit wrong? Your claim gets automatically rejected.

Miss a decimal point? Denied.

Use last year’s code instead of this year’s updated version? Rejected.

Real example: Your doctor codes your broken arm as S42.001A instead of S42.001D. The difference? One letter. The result? Your $3,000 emergency room bill gets denied.

The worst part? Many doctors’ offices don’t have coding specialists. They’re doing their best with an impossible system designed to create errors.

What you can do: Before any procedure, ask your doctor’s office if they’ve verified the correct codes. Many billing departments will double-check if you ask.

Tactic #2: The Missing Information Rejection Machine

Medicare has turned claim processing into a game of “gotcha.” Leave out one piece of information, and your entire claim gets tossed.

Common missing info that kills claims:

- Wrong format for your Medicare ID number

- Missing prior authorization reference number

- Incomplete provider credentials

- Wrongly referring doctor’s information

- Missing diagnosis codes

65% of survey respondents say submitting clean claims is more challenging now than before the pandemic.

The sneaky part: Sometimes Medicare has this information in its system already. They could look it up. But their computer systems are programmed to reject first, ask questions later.

Your defense: Keep a one-page Medicare info sheet with all your details formatted exactly how Medicare wants them. Give copies to every doctor’s office you visit.

Tactic #3: The Filing Deadline Trap You Never See Coming

Medicare gives providers 12 months to submit most claims. Miss that deadline by even one day? Too bad. Claim denied.

But here’s the dirty secret: You don’t control when your doctor submits the claim. You might not even know there’s a problem until months later.

How this hurts you:

- Your doctor’s office gets busy and forgets to submit

- Insurance coordination delays push past the deadline

- Appeals and corrections eat up time

- You get stuck with the full bill

Some Medicare Advantage plans have even shorter deadlines. They might require claims within 60-90 days.

Your protection: After every medical visit, ask when the claim will be submitted. Follow up in 30 days if you haven’t seen it processed.

Tactic #4: The “Medical Necessity” Scam That Costs You Thousands

This is Medicare’s favorite denial reason. They claim your treatment wasn’t “medically necessary.”

Traditional Medicare’s coverage rules account for 85% of denied services. But here’s what’s shady about it:

The definition of “medically necessary” changes based on:

- Where you live (different regions have different rules)

- Which contractor reviews your claim

- What day of the week do they review it

- How much Medicare wants to save money that month

Real example: A 2022 report by the Office of Inspector General (OIG) found that 18% of Medicare Advantage payment denials actually met Medicare coverage rules. They denied valid claims and hoped you wouldn’t fight back.

Local Coverage Determinations (LCDs) make this worse. These are regional rules that vary wildly across the country. The same surgery might be “necessary” in Texas but “experimental” in Florida.

Your weapon: Before any expensive procedure, ask your doctor to document why it’s medically necessary in your file. Get a copy of this documentation.

Tactic #5: The Duplicate Claims Scheme That Double-Charges You

Duplicate claim denials are one of the top billing errors among Medicare Administrative Contractors.

Here’s how this scam works: Medicare’s computers flag claims as “duplicates” even when they’re not.

Common false duplicates:

- Follow-up visits for the same condition

- Multiple tests for ongoing treatment

- Emergency room visit plus doctor follow-up

- Left knee surgery today, right knee surgery next month

Medicare’s automated systems can’t tell the difference between a real duplicate and legitimate repeat care.

The financial trap: When Medicare denies a “duplicate” claim, you might get billed for both the original service AND the “duplicate” service.

Your defense: Keep detailed records of every medical visit, test, and procedure. When you get a duplicate denial, you’ll have proof that the services were different.

Tactic #6: The Non-Covered Services Bait and Switch

Medicare has a long list of services it won’t cover. Fair enough. But they’ve gotten sneaky about expanding this list without telling anyone.

Services Medicare won’t cover:

- Most routine physical exams

- Cosmetic surgery

- Custodial care

- Experimental treatments

- Some preventive care

But here’s where it gets shady: 61% of Medicare Advantage denials get classified as experimental or investigational, even for standard treatments.

The Advance Beneficiary Notice (ABN) trap: Your doctor is supposed to warn you if Medicare might not cover something. They give you a form called an ABN. Sign it, and you agree to pay if Medicare denies the claim.

The problem is, many doctors don’t really know what Medicare covers. They make you sign ABNs “just in case.” Then you’re stuck with the bill.

Your protection: Before signing any ABN, ask your doctor to check Medicare’s coverage database. Many “non-covered” services are actually covered with the right documentation.

Tactic #7: The Prior Authorization Profit Machine

Medicare Advantage plans denied 3.4 million prior authorization requests in 2022. This isn’t about medical care. It’s about money.

Here’s how prior authorization works as a denial tactic:

- You need treatment

- Your doctor requests permission (prior auth)

- Medicare Advantage plan delays or denies

- You either pay out of pocket or skip treatment

- The insurance company keeps the money it would have spent

The smoking gun: 83.2% of prior authorization appeals are ultimately overturned. If they’re approving most appeals, why deny them in the first place?

A 2024 Senate report found that UnitedHealth’s post-acute services denial rate increased from 8.7% to 22.7% between 2019-2022. UnitedHealth’s skilled nursing home denial rate increased nine times over.

The delay tactic: Even when prior auth gets approved, the delay can be dangerous. Critical treatments get postponed while insurance companies shuffle paperwork.

Your counter-attack: If you need prior authorization, submit the request immediately. Don’t wait for your doctor’s office to “get around to it.”

Tactic #8: AI Robots Designed to Say “No”

This is the newest and maybe the most outrageous tactic. Insurance companies now use artificial intelligence to review claims.

Cigna’s AI system spends just 1.2 seconds reviewing each claim. In two months, this system rejected over 300,000 claims.

1.2 seconds. That’s not enough time to read your name, let alone review your medical history.

Initial claim denials hit 11.8% in 2024, up from 10.2% just a few years earlier. The rise matches exactly when AI claim review systems launched.

How AI denials work:

- Computer scans your claim for keywords

- AI looks for any reason to deny

- System rejects the claim automatically

- Human reviewers rarely double-check

The human factor: There’s a shortage of qualified people to review medical claims. Most hospitals don’t automate any part of their denials management strategy, so they can’t keep up with AI-powered rejections.

Your defense: When you get an AI-generated denial, immediately request human review. Most insurance companies are required to provide this if you ask.

Tactic #9: The Medicare Advantage Profit Squeeze

Medicare Advantage plans have a built-in conflict of interest. The less they spend on your care, the more profit they make.

Medicare Advantage denials result in a 7% net reduction in provider revenue. That’s billions of dollars in denied care.

The post-acute care targeting: More than 20% of Medicare Advantage claims for skilled nursing facilities are initially denied. These are expensive services, so insurance companies have a strong financial motivation to deny them.

The profit motive in action:

- Deny expensive treatments first

- Approve cheap treatments to look reasonable

- Force patients to appeal (most won’t)

- Keep the money when patients give up

The human cost: Patients facing coverage denials rate their satisfaction with their clinical care 8.2 points lower than patients who don’t experience denials.

Your leverage: Remember that Medicare Advantage plans need good ratings to attract customers. If they deny your claims, file complaints with Medicare and your state insurance commissioner.

How to Fight Back and Win Your Appeals

Now for the good news: You can beat these tactics. Medicare overturns about 50% of initial denials on appeal. With the right approach, your odds are even better.

Level 1: Redetermination (60 days to file)

This is your first appeal directly to Medicare. You’re asking them to look at your claim again.

What to include:

- Copy of the denial letter

- Medical records supporting your claim

- Doctor’s letter explaining why treatment was necessary

- Any additional documentation

Success rate: About 50% get overturned

Level 2: Qualified Independent Contractor Review (180 days)

If Level 1 fails, an independent company reviews your case.

Key advantage: This reviewer doesn’t work for Medicare or your insurance company.

Success rate: Higher than Level 1, especially for Medicare Advantage appeals

Level 3: Administrative Law Judge (60 days, minimum $200 in dispute)

This is where serious appeals go. You get a real hearing with a judge.

Important: The dollar minimum amount changes annually. For 2025, it’s $200.

Success rate: Much higher than previous levels

Level 4: Medicare Appeals Council (60 days)

The council reviews the judge’s decision if you’re still not satisfied.

Level 5: Federal District Court (60 days, minimum $1,900 in dispute)

This is the final level. You’re suing in federal court.

Practical advice: Most people don’t need to go this far.