Ten years ago, I thought I was smarter than the market. The mantra was simple: “Buy low, sell high.” It seemed like the most logical thing in the world.

Why would anyone just sit there and ride the market down when you could tactically sidestep the crashes and jump back in for the rallies? I was going to be smart.

This is the story of that ten-year experiment. It’s a journey that began with the confident belief that I could impose order on a complex, chaotic system—a belief rooted not just in financial logic, but in a very human desire for control.

The strategy of market timing, which involves anticipating the best moments to get in and out of the market, is inherently more complicated than its counterpart, the “buy-and-hold” strategy.

It requires you to correctly predict the bottoms to buy and the tops to sell, a feat that seems like the obvious goal for any investor.

I was convinced I could do it. This is the story of the shockingly high price I paid for being “smart.”

The Shocking Verdict: Quantifying the Cost of Being “Smart”

Let’s cut to the chase. After ten years of diligent research, following the news, and making what I believed were strategic moves, my initial $100,000 investment grew to $185,000. Not bad, right?

Until I calculated what would have happened if I had done… nothing. A simple, boring investment in an S&P 500 index fund on day one, left untouched, would have grown to over $290,000.

My attempt to be clever cost me over $100,000 in gains. It cost me the price of a luxury car, a down payment on a house, or years of retirement security.

This phenomenon is known as the “behavior gap.” It’s the difference between an investment’s return and the return the average investor actually gets.

One study highlighted that in a year the S&P 500 returned over 25%, the average investor earned just 16.5%.

That gap of nearly 8.5% wasn’t due to fees or bad luck; it was primarily driven by the emotional decisions of buying high and selling low.

My personal story was a textbook case. The cost wasn’t from a single bad decision, but from the compounding effect of many suboptimal choices that systematically broke the chain of wealth creation.

The Anatomy of a Mistake: Missing the Market’s Best Days

So, how did that $100,000 gap happen? My biggest mistake was thinking I could avoid the bad days.

What I didn’t realize is that the market’s best days—the ones that generate most of the long-term returns—are often disguised.

They don’t arrive when the economic news is positive and everyone is optimistic; they show up in the middle of a storm.

The data on this is staggering. According to analysis from Hartford Funds, if you missed the market’s 10 best days over the past 30 years, your returns would have been cut in half.

Research from Dimensional Fund Advisors shows a similar effect: a hypothetical $1,000 invested in a broad US stock market index from 1998 to 2022 would have grown to $6,356.

But if you missed just the single best week during that 25-year period, your final amount would shrink to $5,304.

This happens because of what can be called the “Proximity Paradox”: the market’s best days and worst days are almost always clustered together during periods of intense volatility.

One analysis found that from 2000 to 2019, six of the market’s ten best days occurred within just two weeks of the ten worst days.

This is why timing is so perilous. The very fear that drives you to sell during a downturn is what ensures you’re on the sidelines for the powerful, unpredictable rebound that often follows.

In fact, an astonishing 78% of the stock market’s best days have occurred during a bear market or within the first two months of a new bull market—exactly when timers are most likely to be hiding in cash.

| Investment Scenario (S&P 500, 30-Year Period) | Final Value of $10,000 Investment | Percentage of Fully Invested Return |

| Remained Fully Invested | $235,600 | 100% |

| Missed the 10 Best Days | $107,900 | 46% |

| Missed the 20 Best Days | $58,700 | 25% |

| Missed the 30 Best Days | $35,100 | 15% |

Note: Data synthesized for illustrative purposes based on findings from multiple sources.9 Actual returns vary.

The Perfect Timer vs. The Consistent Investor: A Surprising Result

I was chasing perfection, trying to be the ultimate market timer. But a famous study by Charles Schwab shows just how misguided that goal is. They tracked four hypothetical investors over a 20-year period, each investing $2,000 annually.

- Peter Perfect had impossible luck and invested his $2,000 at the absolute lowest point of the market each year.

- Ashley-Invests-Right-Away simply invested her $2,000 on the first day of each year, regardless of market conditions.

- Rosie Rotten-Timer had terrible luck, investing her $2,000 at the absolute peak of the market each year.

- Larry-Leaves-in-Cash was too scared to invest and left his money in risk-free Treasury bills.

The results are stunning. Peter Perfect, the flawless timer, ended with the most money. But Ashley, who simply invested immediately, was only slightly behind him.

The most important lesson, however, comes from comparing Rosie and Larry. Rosie, who had the worst possible timing imaginable, still ended up with dramatically more money than Larry, who never invested at all.

The study’s conclusion is clear: even the worst possible market timing was far superior to not investing at all.

Procrastination is more costly than bad timing. This reframes the entire concept of risk. The biggest danger isn’t investing at the “wrong” time; it’s the failure to invest at all.

| The Four Investors: A 20-Year Race |

| Investor Type |

| Peter Perfect |

| Ashley Invests-Right-Away |

| Rosie Rotten-Timer |

| Larry Leaves-in-Cash |

Note: Data based on a Charles Schwab study covering a 20-year period.

Your Brain on Volatility: The Emotional Rollercoaster

If the data is this clear, why do so many of us—myself included—fall into the timing trap? The answer has less to do with spreadsheets and more to do with psychology.

Our brains are simply not wired to handle market volatility rationally.

These emotional responses are not character flaws; they are deep-seated biological instincts that are disastrous when applied to modern financial markets.

Investors are often guided by a predictable emotional cycle. It starts with optimism as the market rises, which builds into excitement and then euphoria at the peak.

This is the point of maximum financial risk, where the fear of missing out (FOMO) drives people to buy high.

As the market turns, anxiety sets in, followed by denial, fear, and ultimately panic, leading investors to sell low to stop the pain.

This cycle is fueled by powerful cognitive biases. One of the strongest is loss aversion, the psychological principle that the pain of a loss is felt about twice as intensely as the pleasure of an equivalent gain.

This is why we are so tempted to sell during a downturn—our brains are screaming at us to make the immediate pain stop, even if it sabotages our long-term goals.

As author Morgan Housel notes, “Having no FOMO might be the most important investing skill”.

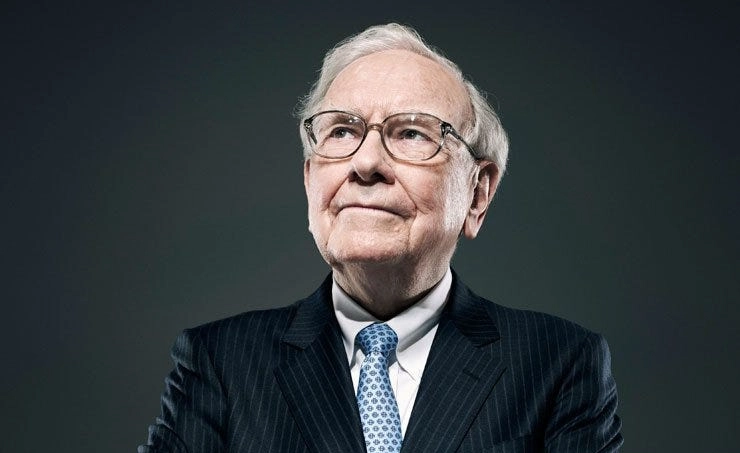

The Wisdom of the Giants: What Warren Buffett Knows That We Don’t

If our own emotions are the enemy, who can we look to for guidance? For decades, Warren Buffett has been the master of investment temperament.

His secret isn’t a crystal ball; it’s a profound understanding that you don’t time the market. He has repeatedly called market timing a “fool’s errand,” arguing that even experts fail to predict short-term movements with any consistency.

Buffett’s genius lies in fundamentally changing the game he is playing.

While market timers are engaged in a short-term game of predicting prices (speculation), Buffett is playing a long-term game of owning businesses (investing).

His most famous principle is to “be fearful when others are greedy and greedy only when others are fearful“—the psychological opposite of what market timers do.

He illustrates this with a simple analogy: if you buy a farm, you don’t get a price quote on it every week and panic-sell if the value dips.

You judge the farm by its output—the bushels of corn and soybeans it produces. Similarly, you should judge a stock by the underlying performance of the business, not its daily price fluctuations.

By shifting his focus from the stock ticker to the business itself, Buffett makes market volatility irrelevant, or even better, an opportunity to buy great companies at a discount.

The Antidote to Timing: Dollar-Cost Averaging and Automation

After my expensive ten-year lesson, I fired myself as a market timer.

I needed a system—a way to invest consistently that would protect me from my own worst instincts. I found it in a simple but powerful strategy: Dollar-Cost Averaging (DCA).

DCA involves investing a fixed amount of money at regular intervals, regardless of the market’s price. For example, investing $500 on the first of every month.

When the market is high, your $500 buys fewer shares. When the market is low, that same $500 buys more shares. This approach automatically helps you buy more when prices are cheap and less when they are expensive.

However, the true power of DCA is not mathematical; it’s behavioral. It is a tool for managing your emotions.

It prevents procrastination, minimizes the potential for regret, and, most importantly, it takes emotion out of the equation.

While some studies show that, historically, investing a lump sum (LSI) all at once has generated higher returns than DCA about 75% of the time, this assumes an investor has the iron will to deploy all their cash and not panic if the market immediately drops.

For most real-world humans, DCA is the psychologically superior strategy. It is a commitment device that ensures you stay in the game, which, as the Schwab study proved, is the most important factor for success.

Your 2026 Investing Playbook: A Simple, Three-Step Guide

So, what does this all mean for you, today, in 2026? It means you can build a powerful, effective investment strategy that is far simpler than you think. Here is the exact playbook I follow now.

- Choose Your Vehicle: Keep it Simple. You don’t need to pick individual stocks. For most investors, the best starting point is a low-cost, broadly diversified index fund or ETF, such as one that tracks the S&P 500. This gives you instant ownership in hundreds of America’s leading companies and ensures your returns will closely match the market’s performance.

- Automate Your Contributions. This is the key to operationalizing DCA and making investing a habit, not a decision. Set up automatic, recurring transfers from your paycheck or bank account directly into your investment account every week or month. Start with tax-advantaged accounts like a 401(k) or an IRA. By making it automatic, you remove the temptation to second-guess and try to time your entry.

- Stay the Course: Tune Out the Noise. Once your system is automated, the hardest part is leaving it alone. Resist the urge to check your portfolio daily. Ignore the breathless headlines and the market forecasts. As financial planner David Tenerelli advises, “a long-term, buy-and-hold, diversified, low-cost investment approach is likely more suitable than active trading”. Trust the process and let time and compounding do their work.

Conclusion: The Real Price of Market Timing Isn’t Just Money

The $100,000 I left on the table is a painful number. But over the last decade, I’ve realized the true cost of trying to time the market was even higher.

It was the hours I wasted staring at charts. The anxiety during every market dip. The mental energy consumed by a game that is rigged against me.

The buy-and-hold approach is not only more profitable, but as investment expert Paul Merriman notes, it is also far more peaceful and carries fewer emotional and behavioral risks.

Today, my automated investment plan takes about 15 minutes a year to review. I’ve gained back not just financial returns, but my time and my peace of mind.

In investing, as in life, stillness often brings clarity.

The best strategy is one that allows you to build wealth quietly and consistently in the background, freeing you to focus on what truly matters. And that is a return you can’t calculate.