You make decent money. Yet your savings account looks the same as it did last year.

Maybe you got a raise. But somehow, you still feel broke.

You’re not alone. And you’re not bad with money.

The problem is simpler and scarier than you think. Small monthly leaks are draining over $2,000 from your budget. You barely notice them. But they’re stealing your future.

Here’s what makes this so dangerous: That $2,000 monthly isn’t just gone. It’s money that could have grown into $2.8 million over 30 years. Instead, it vanished into things you don’t even remember buying.

This article shows you exactly where that money goes. More importantly, it shows you how to stop the bleeding today.

Mistake #1: The Subscription Trap ($118-$219 Vanishing Monthly)

Pull up your bank statement right now.

Look at all those small charges. Netflix. Spotify. That gym you haven’t visited since February. The app you forgot you’re paying for.

Here’s what the research shows: The average person has 8.2 subscriptions and spends $118 per month on them. That’s $1,416 every year.

But it gets worse.

According to a 2022 study by C+R Research, people think they spend $86 per month on subscriptions, but the real number is $219. You’re spending $133 more than you realize. Every single month.

Why does this happen? Auto-renewal. You sign up for a free trial. You forgot to cancel. Three months later, you’re still paying $14.99 for something you used once.

The study found that 74% of people say it’s easy to forget about recurring monthly charges. And almost 55% admit they have at least one subscription they’re paying for but not using.

Let me show you what this really costs.

That $118 per month doesn’t sound terrible. But invested at 8% annual returns over 30 years? It becomes $176,841.

Here’s what people don’t realize: Streaming costs jumped 30% from $48 in 2023 to $61 in 2024. Companies keep raising prices. You keep paying.

What to Do Right Now

Open your banking app. Look at the last 60 days. Write down every subscription.

Ask yourself: “Did I use this in the last month?”

If the answer is no, cancel it. Don’t say “I might use it later.” You won’t.

Cancel at least three subscriptions today. That’s $30-60 back in your pocket immediately.

Mistake #2: The Car Payment Trap ($749 Bleeding Out Monthly)

That car in your driveway is probably your second-biggest monthly expense. And it’s killing your wealth.

The average car payment for a new vehicle hit $749 per month in the second quarter of 2025. Used cars aren’t much better at $529 monthly.

Here’s the part that hurts: Your car loses value the second you drive it off the lot. But you’re still making payments for six years. Sometimes longer.

Middle-tier credit borrowers now take out loans averaging 75 months. That’s over six years of payments on something that loses 55% of its value during that time.

You finance a $42,000 SUV at 7% interest over 72 months. You’ll pay about $10,000 in interest alone. Total cost: $52,000.

Meanwhile, that SUV is now worth maybe $23,000. You lost $29,000 in six years.

Matt Schulz, chief consumer finance analyst at LendingTree, said it best: “That’s such a long time to be stuck paying for a depreciating asset. That money going toward a car payment isn’t earning interest and funding your emergency savings, your retirement nest egg, a mortgage down payment, or your kid’s college fund.”

The Real Cost Nobody Talks About

That $749 monthly payment over 30 years at 8% return equals $1,122,473. Over one million dollars. Gone.

Compare this: Buy a reliable used car for $20,000. Your payment: maybe $400 monthly for 36 months instead of 72.

The difference: $349 per month freed up. Invested for over 30 years at 8%? That’s $522,506.

What to Do Right Now

If you have a car payment over $600, ask yourself: “Do I really need this car?”

Not “Do I like it?” Do you need it?

Start saving for your next car in cash. When this loan ends, buy something reliable for half the price.

Mistake #3: The Compound Interest You’re NOT Earning

Here’s the number that should keep you up at night: $2,851,567.

That’s what $2,000 invested monthly becomes in 30 years at 8% average returns.

But you’re not investing $2,000 monthly. It’s leaking out through subscriptions, car payments, and other holes.

So you’re not building that $2.8 million. You’re building nothing.

The Math That Changes Everything

Start with just $500 per month. Invest it for 30 years at 8% annual returns.

You put in $180,000 total. It grows to $712,891. You more than tripled your money.

Increase that to $1,000 monthly. Your $360,000 becomes $1,425,783.

But here’s where it gets crazy: If you wait 10 years to start, you can’t catch up. Even if you double your monthly contribution.

Starting at 25 with $500/month beats starting at 35 with $1,000/month. Time matters more than money.

What to Do Right Now

Open a retirement account if you don’t have one. Start with your employer’s 401(k) if they offer matching. That’s free money.

No 401(k)? Open a Roth IRA. You can start with $50.

Set up automatic transfers. The amount doesn’t matter as much as starting. $100 monthly beats $0 monthly by infinity.

Mistake #4: Letting Raises Disappear (Lifestyle Inflation)

Remember your last raise? Where did it go?

If you can’t answer that question specifically, lifestyle inflation ate it.

You get a $5,000 annual raise. That’s about $300 more per month after taxes.

Week one: “I should save this.”

Month three: The $300 is gone. New apartment, nicer restaurants, better coffee, more online shopping.

Six months later: You feel exactly as broke as before the raise.

The research backs this up. Real wages for middle-income workers increased less than 0.5% annually over the past decade, while the cost of living jumped 33% from 2015 to 2025.

But here’s the shocking part: Despite average wages rising 21.4% between January 2020 and January 2024, the personal savings rate dropped from 7.2% to 4%.

We’re earning more. Saving less. Because every raise becomes the new baseline.

How It Sneaks Up on You

It happens in small steps:

- Moving from a $1,500 apartment to a $2,000 apartment

- Getting DoorDash three times a week instead of once

- Upgrading streaming services

- Buying the $6 fancy coffee instead of making it at home

According to a 2025 study by the Financial Health Network analyzing over 20 consumer financial products, increasing debt balances and higher borrowing costs led to a dramatic increase in total spending on fees and interest, directly impacting families’ bottom line.

What to Do Right Now

Next time you get a raise, increase your automatic retirement contribution by that exact amount immediately.

Got a $200 monthly raise? Add $200 to your 401(k) before you see it.

Your lifestyle stays the same. Your future gets dramatically better.

Mistake #5: Paying Interest Instead of Earning It

Credit card companies love the middle class. Why? Because we make enough to qualify for high credit limits. But we carry balances.

The average credit card interest rate currently hovers around 20%, with some cards charging nearly 30%.

The Minimum Payment Trap

You have a $5,000 credit card balance at 20% interest. You make minimum payments of about $150 monthly.

That $5,000 balance will grow to nearly $6,000 in just one year if you only make minimum payments.

You paid $1,800 over the year. Your balance went down $800. Where did the other $1,000 go? Interest.

Keep making minimum payments? It’ll take you 17 years to pay off. You’ll pay $8,200 in interest on a $5,000 balance.

Why This Happens

You’re not dumb. You’re squeezed.

Median home prices in many metro areas surged 20-25% over the past three years. Groceries cost more. Everything costs more.

Real wages increased less than 0.5% annually, while the cost of living increased much faster.

So you use credit cards to maintain your lifestyle. The balance grows.

Compare the results:

- $200 monthly in credit card interest over 30 years = $72,000 paid, $0 gained

- $200 monthly invested at 8% over 30 years = $285,156 gained

What to Do Right Now

List all your credit cards with balances and interest rates.

Attack the highest interest rate first. Pay minimums on everything else. Throw every extra dollar at the highest rate card.

Stop using credit cards while paying them off. If you can’t afford it in cash, you can’t afford it.

Mistake #6: The Housing Money Pit

Your home should be your biggest asset. For many middle-class families, it’s their biggest liability.

Middle-class families now allocate 35-40% of their monthly income to housing expenses, well above the 30% threshold financial experts recommend.

The Numbers Tell the Story

The average 30-year mortgage rate climbed to 7.00% in early 2025.

You bought a $400,000 home with 10% down. You’re financing $360,000.

At 7% interest over 30 years:

- Monthly payment: $2,394 (principal and interest)

- Add property taxes, insurance, maintenance: $850/month

- Total: $3,244 monthly

If you make $90,000 per year, that’s 43% of your income on housing.

Nearly 30% of middle-class homeowners who purchased recently are “cost-burdened,” spending more than 30% of their income on monthly housing payments.

Being house-poor means you can’t save for emergencies, invest for retirement, or build wealth.

What to Do Right Now

If you haven’t bought yet: Don’t stretch to the max the bank approves. Aim for 25% of gross income on housing.

Already own and struggling? Consider renting out a room, refinancing if rates drop, or selling and downsizing.

That last one is hard to hear. But would you rather have a big house or a comfortable retirement?

Mistake #7: The Convenience Tax ($300-500 Vanishing Monthly)

You’re tired after work. You don’t want to cook. You open DoorDash.

That $15 meal costs $25 after fees and tip. But you’re exhausted. It feels worth it.

This happens three times this week. Then four times next week.

Before you know it, you’re spending $400 monthly on food delivery and restaurants. You could have made the same food for $120.

That’s $280 down the drain. Every single month.

The Small Choices That Add Up

Let’s break down what convenience really costs you:

Morning coffee: $6 daily = $180 monthly (could make at home for $30)

Lunch at work: $12 daily = $240 monthly (could pack for $60)

Food delivery: $30 twice weekly = $240 monthly (could cook for $80)

Total convenience tax: $490 monthly

That $490 monthly over 30 years at 8% return becomes $734,493.

Three-quarters of a million dollars. Spent on being too tired to cook.

Why This Happens

You tell yourself it’s just this once. You’ll cook tomorrow.

Tomorrow comes. You’re just as tired. So you order again.

The apps make it so easy. One click. Food shows up. No dishes. No effort.

But that ease is expensive.

What to Do Right Now

Track every food purchase for two weeks. Everything. The coffee. The snack. The lunch. The dinner.

Add it up. The number will shock you.

Then try this:

The 50% Rule: Cut your eating out by half. Not completely. Just half.

Meal prep Sunday: Spend two hours making five dinners. Saves you $200-300 monthly.

Pack lunch for four days: Save $180 monthly by bringing lunch instead of buying.

Keep emergency meals: Frozen pizzas. Pasta. Canned soup. Things you can make in 15 minutes when you’re exhausted.

How to Stop Bleeding $2,000+ Monthly (Your Action Plan)

Don’t try to fix everything at once. Pick one action from each category.

Week 1: Subscription Audit

- Download a free budgeting app

- Review all recurring charges from the last 60 days

- Cancel at least 3 subscriptions you don’t use

- Set a quarterly reminder to review subscriptions

Target savings: $50-150 monthly

Week 2: Car Reality Check

Calculate your total car costs: payment, insurance, gas, maintenance, registration.

Is it more than 15% of your gross income? You’re spending too much.

Start planning your next vehicle purchase for half what you currently owe.

Target savings: $200-400 monthly (when you replace your current car)

Week 3: Automate Investing

Open a retirement account. Start with your employer’s 401(k) to get the match.

Set up automatic transfers for $100-200 monthly. Increase it 1% every quarter.

Target investment: $200-500 monthly to start

Week 4: Attack Debt

List all debts by interest rate, highest to lowest.

Call your credit card companies and ask for a lower rate.

Set up autopay for minimums, then manually pay extra on the highest rate card.

Target: Pay $300+ extra monthly on high-interest debt

Track Everything for 30 Days

Track every single purchase for one month. It’s annoying. Do it anyway.

You’ll discover you spend $400/month eating out when you thought it was $150.

Awareness creates change. You can’t fix what you don’t measure.

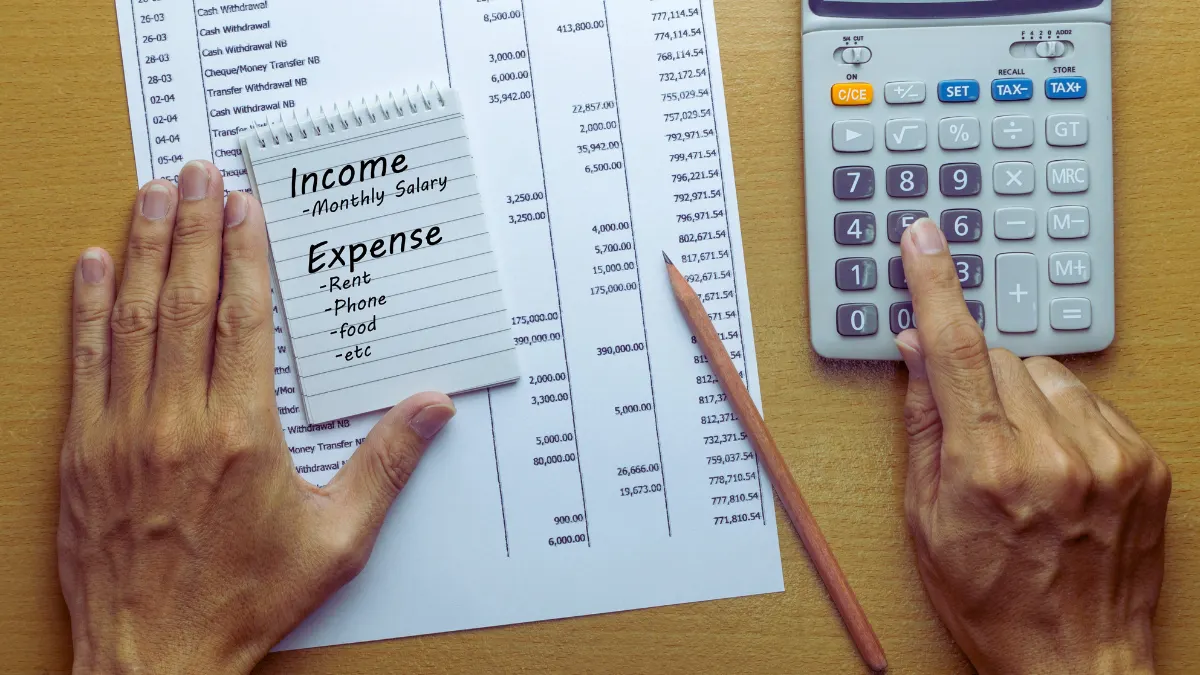

The Math That Should Motivate You

Let’s add up the average leaks:

- Subscriptions: $219/month

- Excessive car payment: $349/month

- Lost compound interest opportunity: $500/month

- Credit card interest: $200/month

- Housing over-spending: $500/month

Total: $1,768 monthly

Round up to $2,000 for other small leaks.

Plug just half of those leaks: $1,000 monthly invested at 8% for 30 years = $1,425,783

You don’t need to be perfect. You need to redirect half of what’s currently leaking out.

That’s the difference between retiring comfortably and working until 70.

Your Next 24 Hours

Don’t close this article and forget about it. Do one thing in the next 24 hours:

Option 1: Cancel three subscriptions right now. Takes 15 minutes. Saves $50+ monthly.

Option 2: Open a Roth IRA and set up a $100 automatic monthly transfer. Takes 30 minutes. Builds $142,578 over 30 years.

Option 3: Call your credit card company and ask for a rate reduction. Takes 10 minutes. It could save thousands.

Option 4: Calculate your total monthly expenses and see where you really stand. Takes 45 minutes. Changes everything.

Pick one. Do it now.

Because every day you wait, compound interest works against you instead of for you.

The $2,000 monthly mistake isn’t one catastrophic decision. It’s a hundred small leaks you barely notice.

But here’s the good news: You can plug them in one at a time.

Start today. Your future self will thank you.