Everyone tells you to wait. “Delay your Social Security until 70,” they say. “You’ll get the biggest check possible.”

But what if that advice is wrong? What if waiting could cost you tens of thousands of dollars?

Here’s the truth: delaying Social Security benefits until 70 isn’t always smart. In fact, for many Americans, it’s a costly mistake.

You’re about to learn when delaying hurts instead of helps. We’ll show you how to calculate your break-even point. And we’ll give you a simple way to decide what’s right for you.

By the end, you’ll know if you should claim now or wait. No more guessing. No more bad advice.

The Big Lie About Waiting Until 70

Your financial advisor tells you to wait. The government says you’ll get bigger checks. But they’re not telling you the whole story.

Yes, your monthly check grows by 8% for each year you delay past your full retirement age. If your full retirement age is 67, waiting until 70 means 24% more money each month.

Sounds great, right? But here’s what they don’t tell you: You give up three years of benefits. Three years of checks you could have been cashing.

Let’s say you’d get $2,500 per month at age 67. If you wait until 70, you’ll get $3,100 per month. That’s $600 more each month.

But you gave up 36 months of $2,500 checks. That’s $90,000 you didn’t collect.

How long does it take to make up that $90,000? At $600 extra per month, it takes 12.5 years. You need to live to 82.5 just to break even.

Why Most People Get This Wrong

Most people think bigger is always better. They see that 8% increase and think it’s free money.

It’s not free. You’re trading time for money. And time might be the one thing you don’t have enough of.

Research from Boston College shows that many people who wait for bigger Social Security checks die before they collect enough extra money to make up for what they missed. The researchers looked at real claiming data and life expectancy tables. Their conclusion? Only people who live well into their 80s benefit from waiting.

Here’s another problem: You might need the money now. Maybe you lost your job at 65. Maybe your spouse got sick. Maybe the stock market crashed, and your 401 (k) is worth half what it was last year.

When you need money, you need it now. Future bigger checks don’t pay today’s bills.

The Hidden $30,000 Cost

Here’s where it gets expensive. Most people don’t think about what happens to the money they don’t claim.

Let’s say you’re 67 and decide to wait until 70. You’re giving up $2,500 per month for 36 months. That’s $90,000.

But what if you claimed that money and invested it? Even at a conservative 4% return, that $90,000 could grow to about $120,000 by the time you’re 82.

Now compare: If you delayed, you’d collect an extra $600 per month for 12 years (from age 70 to 82). That’s $86,400.

If you claimed early and invested, you’d have $120,000. The difference? About $34,000.

This is the hidden cost nobody talks about. You don’t just lose the money you didn’t claim. You lose the money that money could have earned.

Who Should Actually Wait Until 70

Don’t get us wrong. Waiting can make sense for some people. But you need to check all these boxes:

- You’re in great health. Not just “okay for your age.” Great. You exercise regularly. You don’t smoke. Your family has a history of living into their 90s.

- You don’t need the money. You have enough income from other sources. Your spouse is still working. You have a big pension or lots of money saved.

- You’re still working. If you’re earning good money, Social Security benefits might be taxed heavily anyway. Waiting can make sense here.

- You want to leave money to your heirs. Higher Social Security means you can leave more of your other savings to your kids.

If you don’t check all these boxes, waiting might be a mistake.

When You Should Claim Early

Here are the signs you should claim Social Security as soon as you can:

- You’re not in perfect health. This is the big one. If you have diabetes, heart problems, or any chronic condition, don’t wait. The average American lives to about 79. If you’re dealing with health issues, you might not make it to the break-even point.

- You need the money now. There’s no shame in this. If you lost your job or had big medical bills, claim your benefits. A guaranteed $2,500 per month beats a theoretical $3,100 per month you might never see.

- You’re worried about Social Security going broke. The program has problems. The trust fund is expected to run short around 2034. Benefits might get cut by 20% or more. A bird in the hand is worth two in the bush.

- Your spouse never worked much. If your spouse will claim spousal benefits based on your record, delaying might not help much. Run the numbers on total household benefits, not just your check.

Research from the National Bureau of Economic Research shows that about 40% of people who delay benefits don’t live long enough to come out ahead financially. The study tracked actual claiming decisions and outcomes over 20 years.

How to Calculate Your Break-Even Point

Here’s a simple way to figure out if waiting makes sense for you:

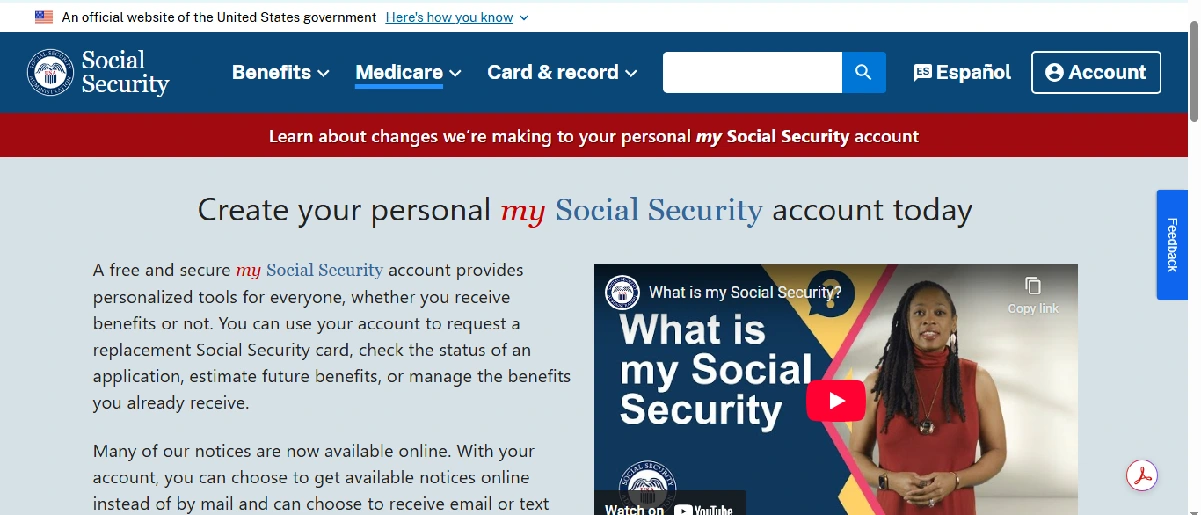

- Step 1: Find your full retirement age benefit amount. Log in to your Social Security account at ssa.gov. Look for your estimated monthly benefit at full retirement age.

- Step 2: Calculate your age 70 benefit. Multiply your full retirement age benefit by 1.24 if your full retirement age is 67. (That’s the 24% increase from delayed credits.)

- Step 3: Find the monthly difference. Subtract your full retirement age benefit from your age 70 benefit.

- Step 4: Calculate total missed benefits. Take your age 67 benefit and multiply it by 36. This shows how much money you’d miss by waiting three years.

- Step 5: Find your break-even time. Divide the total missed benefits by the monthly difference.

- Step 6: Add the break-even time to age 70. This is how old you need to be to come out ahead.

Let’s use real numbers. Say your benefit at 67 would be $2,400 per month.

- Your benefit at 70 would be $2,976 ($2,400 × 1.24)

- Monthly difference: $576

- Total missed benefits: $86,400 ($2,400 × 36)

- Break-even time: 150 months ($86,400 ÷ $576)

- Break-even age: 82.5 years old (70 + 12.5 years)

If you think you’ll live past 82.5, waiting might make sense. If not, claim at 67.

The Smart Way to Decide

Don’t just look at the math. Think about your whole life.

- Consider your health honestly. Not what you hope will happen. What’s realistic based on your current health and family history?

- Think about your money needs. Do you have enough to live on without Social Security? Can you really afford to wait three years?

- Factor in your stress level. Some people worry constantly about Social Security going broke or benefit cuts. If that’s you, claim early and sleep better.

- Talk to your spouse. This affects both of you. Maybe one of you should claim early, and the other should wait. No rule says you both have to do the same thing.

- Consider taxes. Social Security benefits can be taxed. If you have other income, your benefits might be taxed at rates up to 85%. This changes the math.

What to Do Right Now

If you’re thinking about claiming Social Security, don’t wait to start planning. Here’s what to do this week:

- Log in to your Social Security account. If you don’t have one, create it at ssa.gov. Look at your benefit estimates for different claiming ages.

- Check your earnings record. Make sure all your years of work are recorded correctly. Mistakes happen, and they can cost you money.

- Consider your health insurance. If you’re planning to delay Social Security, how will you pay for health insurance? Medicare starts at 65, but you might need to buy a bridge policy.

- Run the numbers for your spouse. Don’t just think about your benefits. Think about the total household Social Security income.

- Set a deadline for your decision. Don’t let this drag on forever. Pick a date by which you’ll decide and stick to it.